Penn Virginia (PVA) stock has gained 16% since the company announced its acquisition of Magnum Hunter's (MHR) Eagle Ford properties and highly successful $775 million debt refinancing (the stock closed at $4.64 on June 17, up $0.64 from the closing price of $4.00 on April 9). However, the move translates to only a small change in the company's enterprise value (less than 3%), leaving the stock's risk/reward profile and valuation thesis largely intact.

(click to enlarge)

(Source: Yahoo Finance)

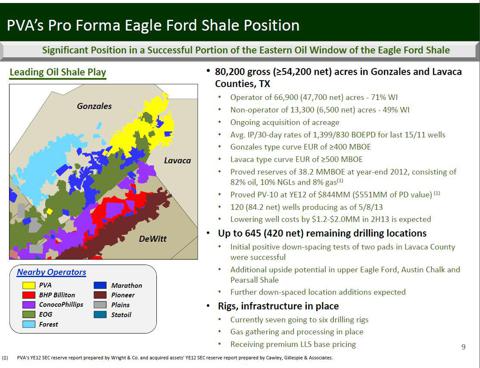

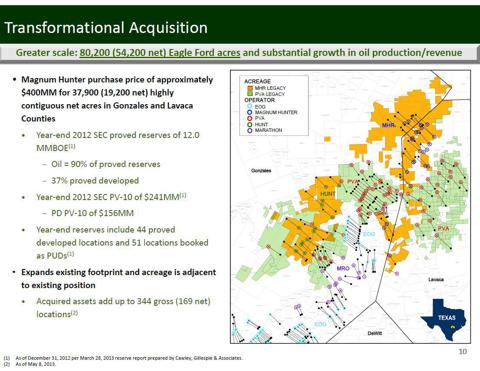

The Magnum Hunter transaction was indeed a transformational - and very daring - strategic move by Penn Virginia that redefined the company's operational complexion and valuation. Penn Virginia has emerged as a focused Eagle Ford pure play with a high-quality, concentrated acreage position in what increasingly appears to be the continuation of the core area of the volatile oil window in Gonzales and Lavaca Counties. Despite the company's extreme financial leverage (which leads to the shares' high price volatility and market "beta"), the stock is highly intriguing from an investment perspective and deserves a close look.

(click to enlarge)

(Source: Penn Virginia's May 2013 Investor Presentation)

Penn Virginia is akin to an LBO situation: the underlying assets are of high quality with significant potential upside; the business plan is defined and focused; financing is in place; and while risks are clearly amplified by financial leverage, a disciplined and effective operational execution may lead to substantial rewards.

NOTE: Please read Disclaimer at the end of this article.

Investment Considerations

Several aspects make Penn Virginia stock intriguing from an investment perspective:

- Operationally, Penn Virginia is essentially a single-asset development "story." With over 120 wells drilled to date on the company's acreage - which is compact and highly contiguous - a significant part of the leasehold is now thoroughly delineated. Well performance data provided by Penn Virginia and Magnum Hunter, as well as results by offset operators (EOG Resources (EOG) and Marathon Oil (MRO)), indicate that a large portion of the block is within the highly productive section of the volatile oil window. Notably, some of the most prolific wells in the Eagle Ford drilled by EOG (including the play's best well to date) are located less than five miles away from the southern tip of Penn Virginia's acreage.

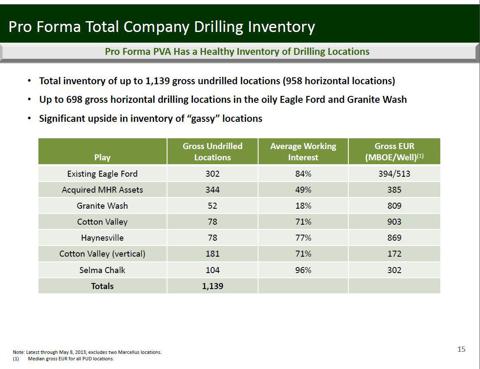

- Despite the block's ostensibly small size (54,000 net acres), Penn Virginia has been able to identify 420 net future drilling locations on its acreage - the result of the exceptionally tight downspacing that has been proven effective in the play. Even assuming that only half of the identified drillsites are "top tier" locations, those best locations should be sufficient for half a decade of low-risk exploitation drilling.

- The highly successful refinancing in April has substantially improved the company's liquidity and pushed out bond maturities. On a pro forma basis, as of March 31, 2013, Penn Virginia had no draw down on its revolver (which has been recently increased to $350 million, the high end of expectation) and there are no bond maturities until 2019.

- Based on the estimates for well economics provided by Penn Virginia (which are in line with the estimates previously communicated by Magnum Hunter), even after a 50% "haircut" to the 420 drilling location count, there can still be significant upside to the company's current Enterprise Value - as much as $0.4-$0.7 billion, or ~25%-45%. Given the very high proportion of debt in Penn Virginia's capital structure, this implies that the stock price could potentially double or even triple over the next two-three years, should the company's operational performance during that period remain in line with recent drilling results (current market value of Penn Virginia's equity is approximately $0.4 billion, including the convertible, while the Enterprise Value is ~$1.5 billion).

- Additional, potentially significant, upside may come from the ongoing delineation of the Upper Eagle Ford, the second productive interval that the company has recently discovered on its acreage, and additional drilling locations from bolt-on leasing and unitizations with offset operators.

- However, the greatest potential upside to the stock would be from a better-than-expected well performance which should not be ruled out. The much stronger well results that EOG Resources has been able to achieve on some of its leases that are adjacent to Penn Virginia's block suggest that the performance gap may be attributable at least to some degree to EOG's superior well design and completion techniques. If true, this would open the possibility for better wells on Penn Virginia's acreage as the company moves up on the learning curve. The ongoing transition to full development mode should enable Penn Virginia to focus on perfecting its extraction techniques and improve drilling economics.

- Monetization of non-Eagle Ford assets may provide additional catalysts for the stock.

The stock is clearly not without risk:

- The valuation discussed further in this article is derived from the type curve and well economics estimates provided by the company. Given the very steep production decline profiles in the Eagle Ford, estimates of future well performance and ultimate recoveries contain significant, unavoidable uncertainty that cannot be resolved until at least several years of production history is accumulated. This aspect of investment in oil shales is obviously not unique to Penn Virginia. The fact that several highly successful operators, including EOG Resources and Marathon Oil, have allocated the largest portion of their capital spending towards the Eagle Ford and have on multiple occasions characterized it as North America's top horizontal oil play, provides some degree of comfort. Extraction techniques and economics in "young" shale plays also tend to improve with time. Still, well performance remains a risk factor.

- Despite the relatively small size of Penn Virginia's acreage, the geology varies across the block. Drilling economics will vary accordingly.

- High leverage and tight liquidity will remain persistent challenges for the stock for some time. Assuming well performance lives up to the estimates, Penn Virginia certainly has enough drilling inventory in the Eagle Ford to "grow into" its very elevated debt. However, the process will take at least few years. The company's current business plan envisions accelerated drilling pace which will translate in budget deficits for another two years. While the underlying asset base will grow, so will the debt. While in the immediate term liquidity is sufficient, funded with the fully undrawn bank credit facility, the company's credit metrics will remain weak for some time.

Asset Discussion

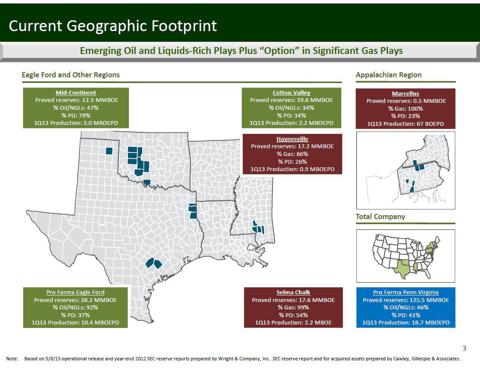

While Penn Virginia's portfolio includes several producing areas (picture below), the company expects the Eagle Ford to be its only active development asset for the foreseeable future. Only minimal amount of capex (~7% of the total in 2013) will be directed towards other areas, mostly for outside-operated capital commitments. However, production contribution (~40% of estimated company-wide production in 2013) and monetization potential of those other areas, particularly the liquids-rich Granite Wash and Cotton Valley plays, should not be overlooked.

(click to enlarge)

(click to enlarge)

(Source: Penn Virginia's May 2013 Investor Presentation)

The Eagle Ford dominates Penn Virginia's asset portfolio both operationally and in terms of its value contribution. The acreage is still in early stages of development. While a larger part of the acreage block is thoroughly mapped out with ~120 wells drilled to date, some smaller areas may still require additional delineation, as can be seen from the drilling location map below. In addition to Penn Virginia's wells, a significant number of wells have been drilled by offset operators, primarily EOG Resources and Marathon Oil, in the immediate proximity to Penn Virginia's properties (discussed in greater detail in the next section).

(click to enlarge)

(Source: Penn Virginia's May 2013 Investor Presentation)

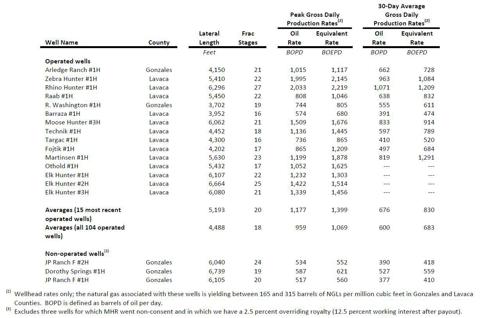

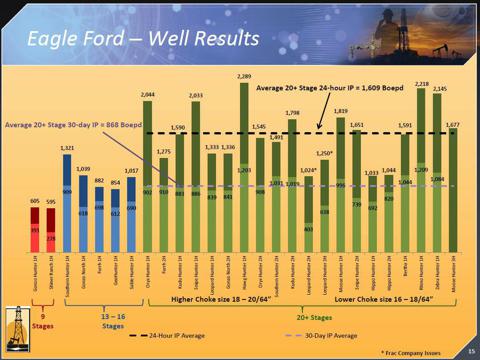

Overall, Penn Virginia's drilling results in the Eagle Ford have been very strong. The average peak IP rate per well for the 104 operated wells completed through the end of April was 1,069 Boe/d. The initial 30-day average IP rate for the 98 of these 104 wells with a 30?day production history was 683 Boe/d.

The average peak gross production rate per well for the 15 most recent operated wells was 1,399 Boe/d. The initial 30-day average gross production rate for the 11 of these 15 wells with a 30-day production history was 830 Boe/d. These recent production improvements are likely attributable to a majority of these recent wells being located in Lavaca County, which is structurally downdip of Gonzales County and, therefore, have an increased reservoir pressure and higher oil and gas production rates. In addition, many of these wells had longer lateral lengths and an increased number of frac stages.

(click to enlarge)

(Source: Penn Virginia)

The table above includes wells drilled both on Penn Virginia's legacy acreage and the acreage acquired from Magnum Hunter. In general, Magnum Hunter's wells have tended to be drilled with longer laterals and more frac stages which explains the differential in the average IP rates.

(click to enlarge)

(Source: Magnum Hunter)

Penn Virginia's most recent effort has been focused on its acreage in Lavaca County which remains the Eagle Ford's "frontier" area. The company has recently commented that it has "completely derisked" and is holding by production its Lavaca County acreage and believes that all of this acreage is "prospective for development drilling." Well results for Lavaca County shown in the table above are uniformly strong and have been a positive surprise. Two recent wells drilled in the far eastern portion of the acreage position confirm the productivity of the company's Lavaca County acreage all the way to the easternmost and southernmost edges. In fact, the Martinsen #1H well which was one of those wells tested ~1,900 Boe/d, including ~1,200 B/d of oil, which is the company's second best Eagle Ford well on all of its acreage.

Penn Virginia is continuing to add to its position in Lavaca County. The company has been able to lease ~2,800 net acres over the past 12 months, with another 4,400 net acres currently in the negotiation stage. According to the company, land costs associated with this "bolt-on" leasing activity can be as low as $1,000 - $1,500 per acre.

(click to enlarge)

(Source: Penn Virginia's May 2013 Investor Presentation)

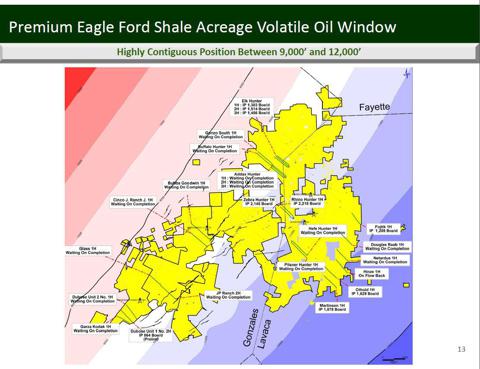

Well productivity and economics in the Eagle Ford have proven to vary drastically depending on the position within the play's fairway. Some of the most prolific wells in the entire Eagle Ford play have been drilled along the relatively narrow band of depths (which define thermal maturity) corresponding to the volatile oil window of the fairway. The slide above shows that a larger part of Penn Virginia's acreage corresponds to the "premium" vertical depth range of 9,000'-12,000'. The map also leads to think that the portion of the company's acreage along the western edge of the block - which corresponds to the shallower part of the fairway (color-coded in pink on the map above) - may not be as productive as the central and eastern portion of the acreage (located within the white and blue bands on the map above). The shallower portion of the acreage is certainly not "condemned" but one would probably want to see drilling results confirming economic competitiveness of this portion of the leasehold.

Offset Operator Results

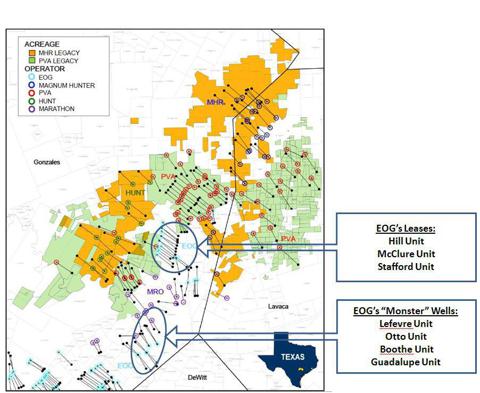

Well results by other operators drilled on adjacent (offset) acreage are of interest as they are not only valuable delineation data points but may indicate what can be achievable if best practices in well design and completion techniques are implemented. Penn Virginia's acreage is offset by EOG Resources and Marathon Oil's positions. EOG's results are of particular importance as EOG is considered a leader in the Eagle Ford in terms of demonstrated well productivity and drilling efficiencies. EOG has commented on multiple occasions that they believe their completion technology is ahead of competition.

Notably, some of the most prolific EOG's wells in Gonzales County (EOG refers to them as "monster wells") have been drilled in very close proximity - less than five miles away, and some of the wells as close as two miles away, - from the southern tip of Penn Virginia's acreage. In its recent presentations, EOG has highlighted IP rates for select wells drilled in Q4 2012 (Boothe Unit) and Q1 2013 (Guadalupe, Lefevre, and Otto Units). Those wells are located in the south-central part on the map below (circled area):

- Boothe #1H: 5,380 b/d of oil + 625 b/d of NGLs + 3.6 MMcf/d of gas (Eagle Ford record)

- Boothe #2H: 3,810 b/d of oil + 525 b/d of NGLs + 3.0 MMcf/d of gas

- Guadalupe #01H, #02H, #03H, #04H: 2,300-3,180 b/d of oil + 265-510 b/d of NGLs + 1.5-2.9 MMcf/d of gas

- Guadalupe #09H, #10H, #11H, #12 H: 2,175-4,490 b/d of oil + 265-630 b/d of NGLs + 1.5-3.6 MMcf/d of gas

- Lefevre #1H: 3,195 b/d of oil + 425 b/d of NGLs + 2.4 MMcf/d of gas

- Lefevre #2H: 3,180 b/d of oil + 525 b/d of NGLs + 3.0 MMcf/d of gas

- Otto #4H, #5H, #6H: 3,125-3,915 b/d of oil + 485-570 b/d of NGLs + 2.8-3.3 MMcf/d of gas

While it would be incorrect to extrapolate these truly extraordinary well results on to Penn Virginia's acreage, the immediate proximity of what appears to be a distinct sweet spot is very intriguing.

(click to enlarge)

(Source: Penn Virginia, Texas RRC, Zeits Energy Analytics)

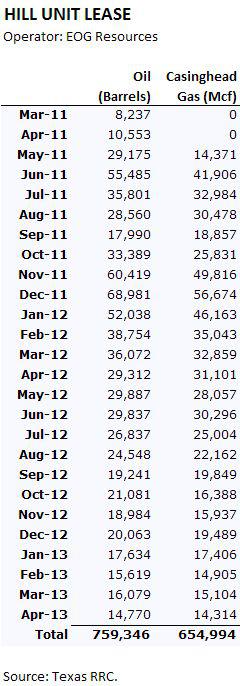

EOG has also drilled or permitted ~30 wells on its leases further north that are located right in the middle of Penn Virginia's position (Hill, McClure and Stafford Units). Production history for those leases, based on Texas RRC data, indicates solid but not extraordinary ("monster") wells. Production history for the Hill Unit lease, which combines production contribution from six wells, is shown below. The six wells have produced 150+ MBoe on average, with the average time on production of ~18 months.

Upper Eagle Ford Discovery

Penn Virginia has recently reported an important discovery well, the Fojtik #1H in Lavaca County, that tested with a strong 24-hour IP rate of ~1,200 MBoe/d, of which 865 b/d is oil. According to the company, the IP rate would correspond to a ~500 MBoe EUR, assuming the existing type curve. The well was completed in the Upper Eagle Ford zone which is different from the Lower Eagle Ford zone where all of the company's previous wells were completed. The upper zone is located about 100 feet above the lower zone and is a calcareous interval, that can be easily fracked, with good porosity characteristics. Penn Virginia is "convinced" that the Lower Eagle Ford and Upper Eagle Ford are actually separate reservoirs and it will take a well in each interval to exploit them. The company does not believe that there will be significant fracture system interference between well completions in the two zones, but recognizes that confirmation by well test results and microseismic will be required to firmly determine that.

Penn Virginia is currently working to determine what parts of its acreage are prospective for the Upper Eagle Ford. By very preliminary estimate, as much as one third of its position may be prospective.

As shown on the map above, the Fojtik well is located at the far eastern edge of the company's acreage. Penn Virginia is drilling another test well in the Upper Eagle Ford about 17 miles southwest of the Fojtik, on the far western part of its acreage in Gonzales County. The well is the middle wellbore of the three-well pad, with two adjacent wellbores (about 700-foot separation) landed in the Lower Eagle Ford. The test should provide relative performance data for the two zones.

Penn Virginia has also suggested that it has seen good shows on logs in a third interval located in the Austin Chalk formation, which is above the Eagle Ford, and has potential to be productive.

While it would be premature to give much valuation credit to the Upper Eagle Ford, the zone has the potential to make a meaningful contribution to the drilling inventory.

Liquidity Considerations

Penn Virginia's business plan anticipates a fast-pace development in the Eagle Ford, which will result in capital spending exceeding operating cash flow in the near term. Current outspending run rate is approximately $50-$60 million per quarter, in my estimate, which will be funded from the revolver. As the company's cash flow from the growing oil production continues to increase, its borrowings under the revolver are expected to continue to decrease as time goes on.

The company projects its Eagle Ford production volumes to grow at a fast rate. During the last nine months of 2013, Eagle Ford production has been guided to average ~13,000 Boe/d net, up from ~10,000 Boe/d net produced during Q1 on a pro forma basis. This implies a 30% growth rate over a six-month period. Penn Virginia expects to be able to self fund its capital program by late 2015 - early 2016. In addition to the undrawn revolver capacity ($350 million currently, expected to increase to $400 million by the end of the year), some asset sales are expected at the end of 2013 or early in 2014 to further improve liquidity. The Selma Chalk properties (106 MMcf of proved reserves as of 12/31/2012, 99% natural gas, 54% developed) may be the first package to be put on the market.

The company may also receive some proceeds if its AMI partners in the Eagle Ford exercise their preference rights to purchase proportional interest in the Magnum Hunter assets (in which case the purchase price of the $400 million would be adjusted down by ~$70 million). The partners' decision should be known this month.

Valuation Considerations

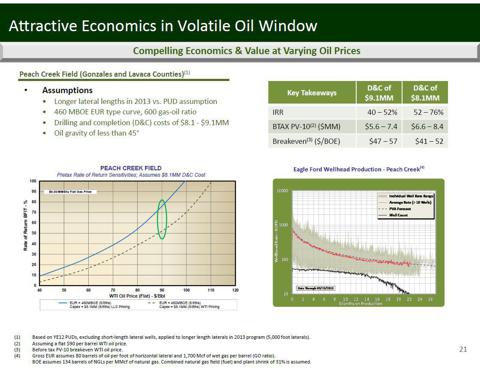

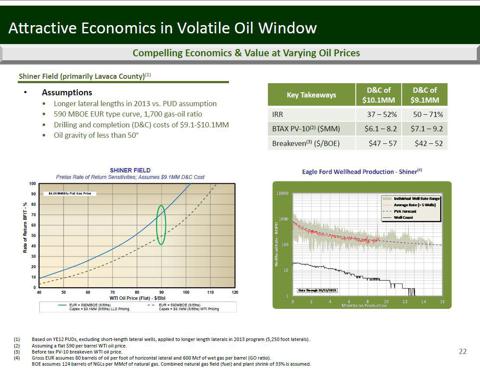

Penn Virginia has recently provided details of its expected drilling economics in the Eagle Ford which are summarized in the following two slides from the company's latest presentation. The slides show economics based on the company's current and projected well costs. The assumed $1 million reduction in drilling and completion cost per well may in fact prove conservative. Penn Virginia commented on its Q1 earnings call that it expects to be able to reduce its well stimulation costs by about a $1.0 million to $1.5 million a well, with the biggest contributing factor being the overall softening of the pressure pumping market in the Eagle Ford. Penn Virginia's existing service contract, which has above-spot-market pricing built into it, is rolling over in July and the company is currently in the process of negotiating a new agreement. On the drilling side, cost reductions are expected to be another $200,000 to $500,000 per well, driven by the transition to pad drilling.

(click to enlarge)

(click to enlarge)

(Source: Penn Virginia's May 2013 Investor Presentation)

The economics are being estimated for two areas - the Peach Creek Field and Shiner Field - that include the company's ~30 existing producing wells. While these estimates may not necessarily represent the average for the entire acreage position, they should provide a reasonable proxy for at least a significant portion of the company's estimated 420 drilling locations.

The slides indicate that investment returns are approximately equal between Peach Creek Field and Shiner Field. The former can be thought of as a proxy for the shallower, oilier acreage on the Gonzales County side of the position, and the latter can serve as a proxy for the deeper, gassier acreage in Lavaca County.

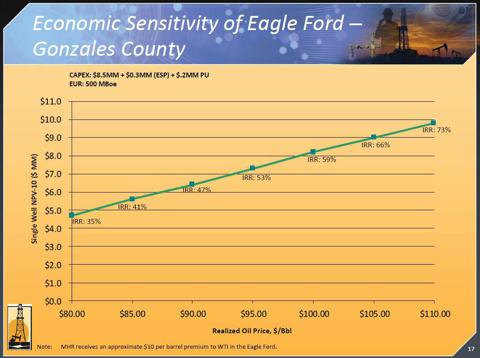

It is important to note that Magnum Hunter, in one of its pre-divestiture presentations, provided drilling economics estimates (shown below) for their Eagle Ford acreage which were similar to Penn Virginia's current assumptions. This provides additional confidence in the applicability of Penn Virginia's drilling economics estimates to a significant portion of the company's acreage.

(click to enlarge)

(Source: Magnum Hunter)

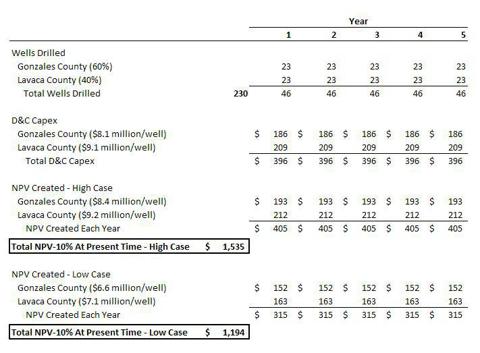

The following illustrative valuation analysis for Penn Virginia's Eagle Ford acreage is based on the company's drilling economics estimates discussed above and assumes a 6-rig development program. The model assumes that the company will drill and complete 46 net Eagle Ford wells each year, with the total number of wells split 50:50 between the shallower and deeper portions of the acreage. Each well is assigned a NPV-10% value based on the company's estimated ranges for Peach Creek and Shiner Fields. Full credit is given to the expected $1 million well cost reduction. The NPVs created in future years are discounted to present time at a 10% rate. The calculation "risks" the company's estimate for the total number of drilling locations by assuming that only half of the 420 locations identified by the company will have economics comparable to Peach Creek and Shiner wells. No credit is given to the remaining potential locations. The model also assumes that Penn Virginia will be able to extend its drilling inventory by ~10% through low-cost bolt-on leasing and unitization with offset operators. The resulting drilling inventory equals to ~230 wells.

(click to enlarge)

The calculation results in a NPV-10% valuation range of $1.2-$1.5 billion which reflects the assumed 230 "premium" drilling locations. The value of existing production or potential value upside from "Tier I" locations and the Upper Eagle Ford potential are not included in this valuation range.

One important observation is in order. The 10% rate used in the illustration above is clearly on the low side, given that uncertainties associated with well economics are still significant. The 10% discount rate should become valid once the drilling inventory (the ~230 wells used in the calculation) is substantially de-risked. Assuming Penn Virginia continues to deliver consistently strong drilling results and the type curve is re-confirmed by well performance, the valuation illustrated above may become very real already in two-three years' time (the entire inventory equates to five years of drilling). In this context, the $1.2-$1.5 billion valuation range is meant to illustrate a "target" valuation for the Eagle Ford asset (discounted to present time) assuming execution lives up to the expectation. This "target" valuation range may prove very conservative with regard to the drilling location count, the Upper Eagle Ford potential, and the possibility of improved well results due to the "learning curve."

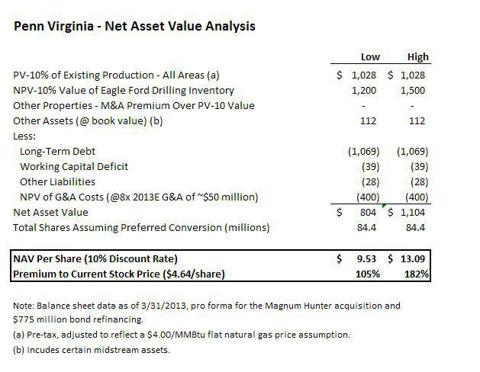

Using this valuation range for the Eagle Ford, the following Net Asset Value per share can be derived:

(click to enlarge)

The NAV range per share suggests that the stock price has a potential to double or even triple over the next two-three years, assuming solid execution. Substantial additional upside can exist on top of that. The illustration also suggests that the stock's risk/reward profile is strongly skewed to the upside.

In the short term, the presence of the convertible preferred ($6 per share conversion price) in the capital structure is likely to create a resistance level around $6, which represents a ~30% premium to current price.

Conclusions

When it comes to the E&P business, there are hardly any guarantees that one should expect in terms of drilling results, long-term production profile, or direction of commodity prices. In the case of Penn Virginia, these risks are exacerbated by very high financial leverage. However, as illustrated by the discussion above, the company's acreage position in the Eagle Ford may prove to contain very significant economic value, despite its ostensibly small size. To appreciate full upside potential of Penn Virginia's assets, it is instructive to model the outcome of a development scenario two-three years forward. Assuming future performance is in line with recent results, the upside to the stock price may be very substantial and may materialize already in a two-three year time frame.

Until recently, Penn Virginia's micro-cap status, stretched-to-the-limit balance sheet, and unfocused asset portfolio may have kept the stock off many institutional investors' radar screens. After the Magnum Hunter acquisition, this may begin to change.

DISCLAIMER: Opinions expressed in this article by the author are not an investment recommendation and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity. The author's opinions expressed herein address only select aspects of potential investment in Penn Virginia's securities and cannot be a substitute for comprehensive investment analysis. Any analysis presented herein is illustrative in nature, limited in scope, based on an incomplete set of information, and has limitations to its accuracy. In the author's opinion, investing in Penn Virginia's securities may not be suitable for many investors and investment risks should be considered very carefully. The author recommends that potential investors conduct thorough investment research and consult a qualified investment advisor. The information upon which this material is based was obtained from sources believed to be reliable, but has not been independently verified. Therefore, the author cannot guarantee its accuracy. Any opinions or estimates constitute the author's best judgment as of the date of publication, and are subject to change without notice.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

How long to cook a turkey green bean casserole green bean casserole recipe red dawn sweet potato pie sweet potato pie Turkey Cooking Time

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.